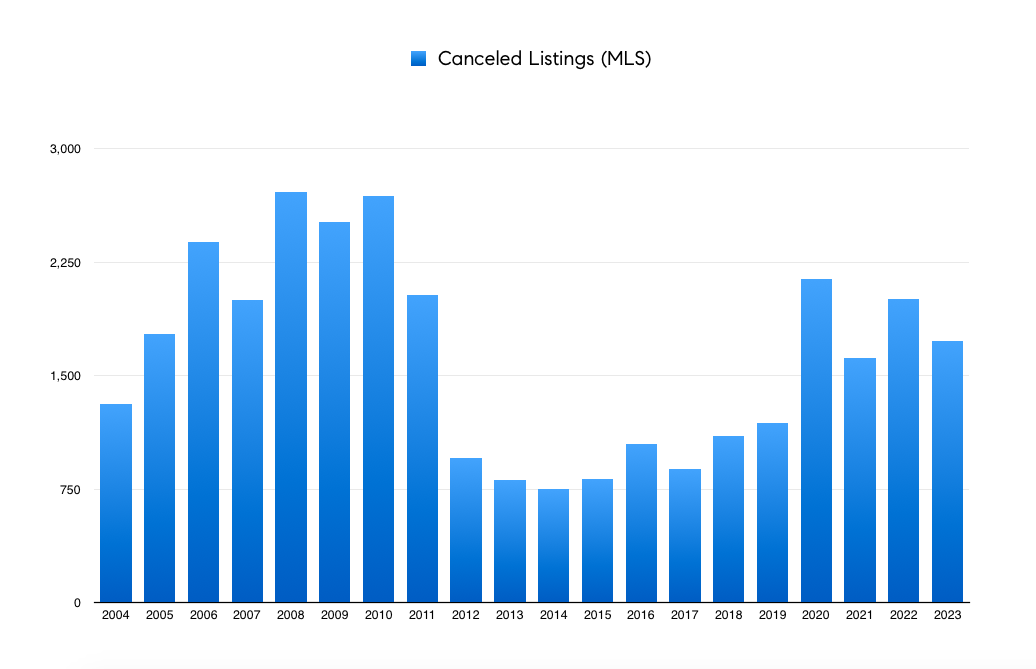

Year-end data is in: San Francisco posted a whopping 1,730 Canceled residential listings in 2023, according to SFAR MLS. While that figure is well below the highest in recent decades (it reached 2,690 in 2010, and was 2,000+ in 2006-2011, 2020 and 2022), it evidences a meager appetite for homes amidst elevated mortgage interest rates, regional labor shifts, and broad economic uncertainty. As citywide median home prices hover around 2018 levels, it also speaks to the large number of would-be sellers who purchased real estate not so long ago and are unwilling to accept a loss on their investment.

Cancel Culture

More than one-third of these cancelations took place in Q4 2023. It’s not unexpected following the deluge of New Listings in September, annually the most active listing month with few exceptions. Those properties unsold as the holiday season approaches face no ideal options: grow stale, advertise seller concessions, or go off market.

Sellers who remain committed to moving — and have some time to spare — will often choose that last option. As per SFAR MLS guidelines, any listing withdrawn for 30+ days may return as New, its days on market reset to zero. Adjusted pricing may be introduced without being labeled a price reduction, and a fresh look can draw the attention of shoppers who initially passed. Combined with advantageous seasonality, it’s a strategy that positions sellers to find that one home buyer willing, able and ready to pay top dollar.

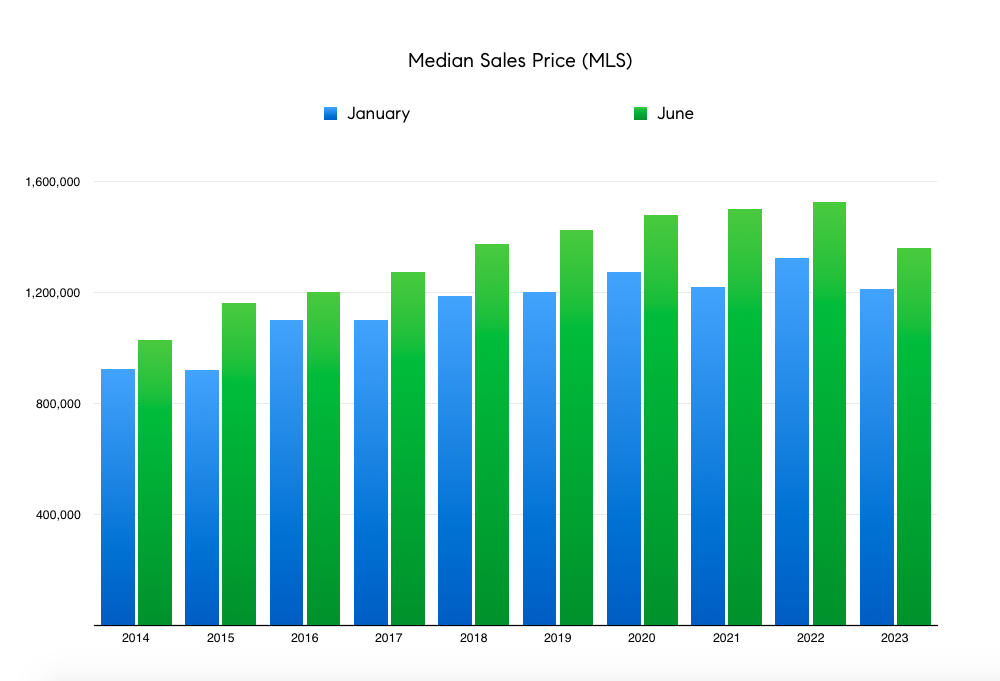

Historically, early February marks the start of San Francisco’s springtime selling season, and sellers who waited are rewarded handsomely. Many listings Canceled in prior months stand to reap double-digit premiums. In fact, the Median Sales Price averaged 16.32 percent higher in June than in January over the last decade; it rose 12.28 percent for the period last year, and more than double that in 2015. A perfect storm is brewing for prices to continue climbing in this new year, and with bidding wars no less. It all boils down to supply and demand.

What Lies Ahead

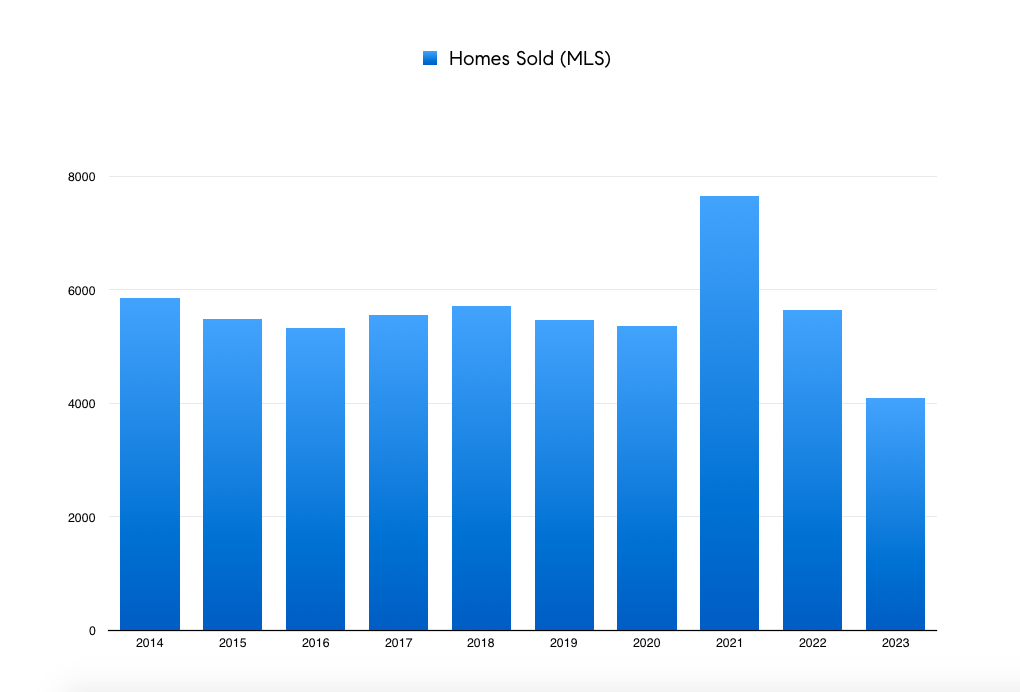

A mere 4,089 homes sold in San Francisco in 2023. For comparison, that 20+ year low is 27.54 percent less than 2022, 46.62 percent less than 2021, and 27.20 percent below the 10-year average. The drop can be accounted for by both fewer listings and fewer buyers actually taking the plunge. But a shift has arrived, and it’ll tip the balance.

Mortgage interest rates, having declined for nine consecutive weeks, are already bringing buyers off the sidelines. According to National Association of REALTORS® Chief Economist Lawrence Yun, this is a sign that the worst is over in terms of home sales. If the Fed begins cutting rates as expected, the benchmark 30-year fixed should fall to the low 6 percent range by year end. (That would be within 50 basis points of the current level, equating to buyers gaining less than 5 percent purchasing power — a net deficit with consideration to predicted rising home prices.)

Meanwhile, there is approximately 12 percent fewer Active listings year-over-year as 2024 starts — less than 500 homes on the market as of 3 January. Segments already experiencing strong price recovery (e.g. Single-Family properties and homes in central neighborhoods) will likely produce a greater share of listings than is typical albeit at near-record prices. Buyers looking for a relative bargain will scoop up increasingly scarce opportunities in lagging segments (e.g. Condo/TIC/Coop units, specially in eastern areas). There, however, even significant price growth over the next 6-12 months is unlikely to unlock adequate pent-up inventory.

And, so, demand chases too little supply, competition heats up and prices rise, more sellers come out to play, confidence grows, and a boom loop begins.

The Getting Is Good

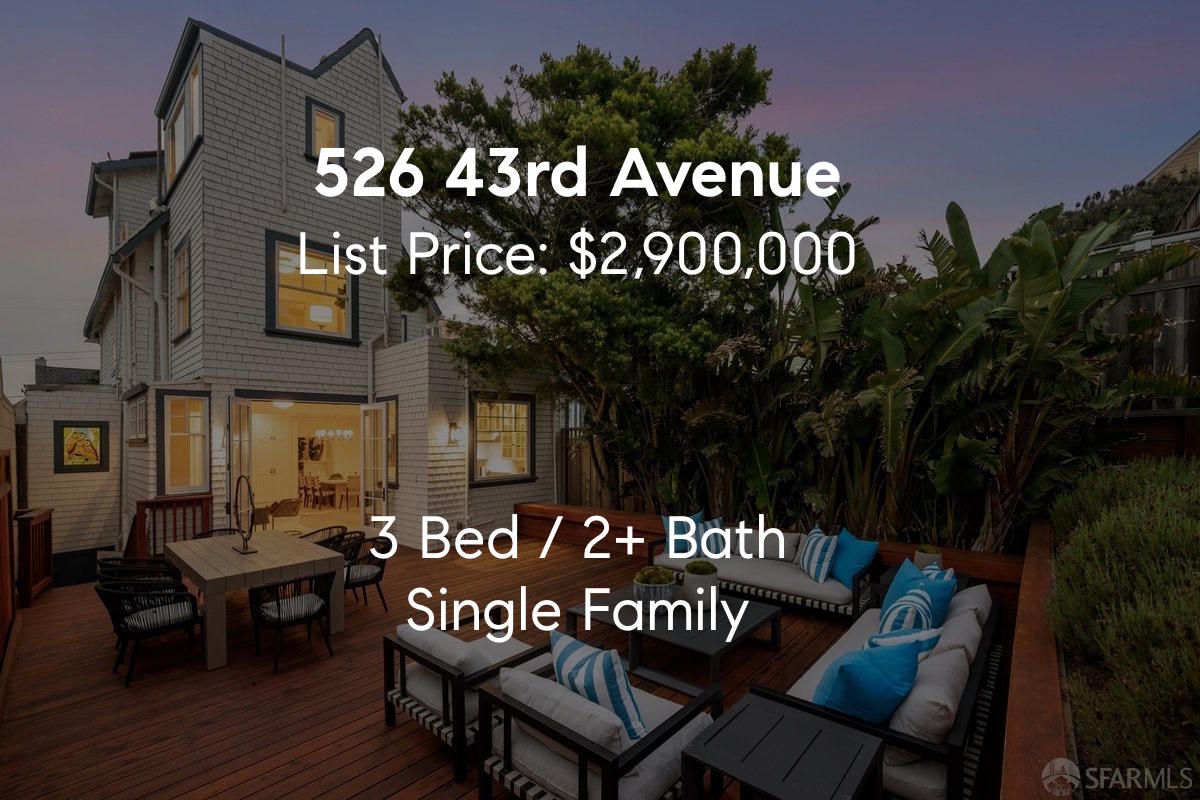

So what’s the deal with those 600+ Canceled listings last quarter? Many are available to be shown to qualified buyers and purchased today. The public won’t see them syndicated to any listing feed, but a REALTOR® interested in earning their keep can lend a hand. Skip the competition. Negotiate a price and terms. And get moving. There are absolutely still sweet opportunities if you know where to look.

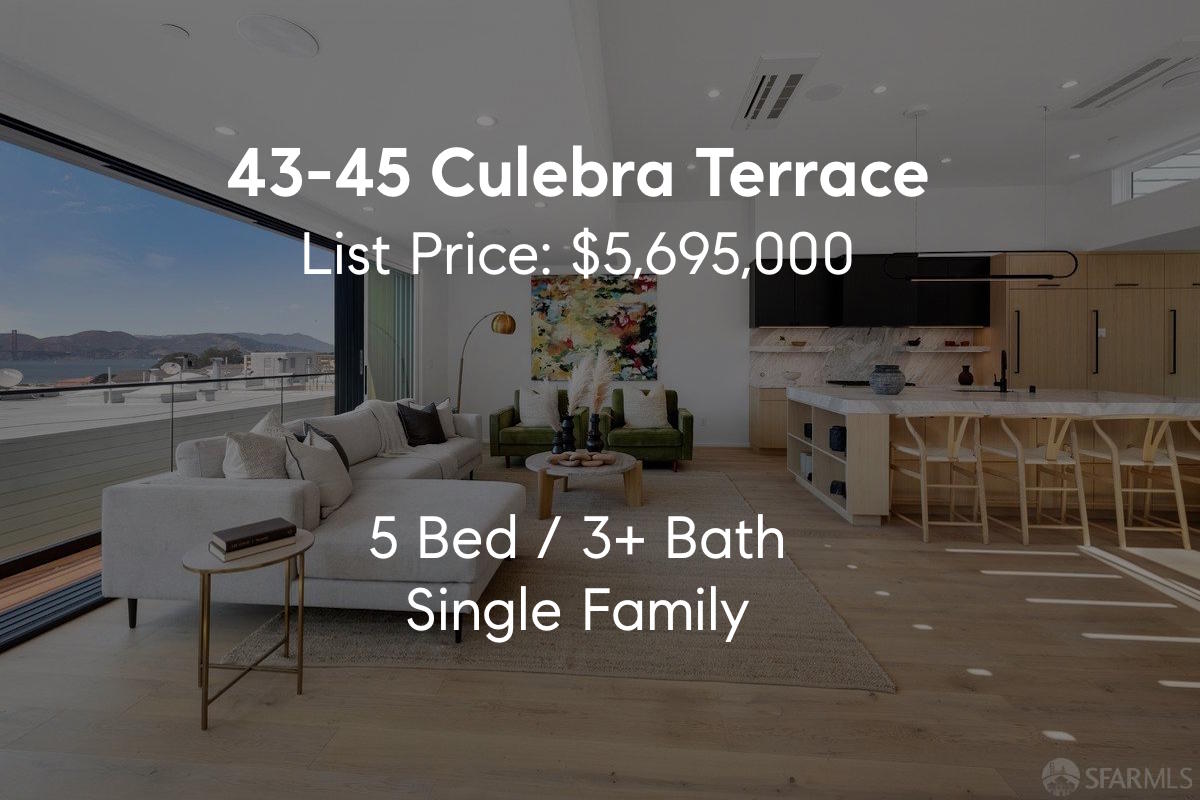

This selection below is only a fraction of what’s out there. Click the images for additional information, and please get in touch to see more.

hey, home buyer

Winning in a real estate market as dynamic as San Francisco’s calls for hyperlocal expertise. We earn our clients' business every time. No pressure, just experience.

Tap that icon to the right. Let's talk.

Ready To Make Your Move?

CONSULT WITH A LOCAL LENDER AND OBTAIN PRE-APPROVAL

› This is essential before making an offer, and can take anywhere from a few days to a week or more. Consider speaking with more than one lender and making them compete for your business. Having your loan file already reviewed by the underwriter will allow you to make a stronger offer. If you plan to stay put in your new home for only a few years, choosing an adjustable-rate product will lower your interest payment. Contact us and we can point you in the right direction.

GET FAMILIAR WITH HOMES FOR SALE AND RECENTLY SOLD

› Homes today are more likely to sell at or near the asking price, but this is by no means a rule. Egregious underpricing is still a common strategy used by sellers and their agents to attract interest (and multiple offers). Be willing to compromise on your wants — if you wait to find the perfect home, you’ll be waiting forever. You can upgrade and personalize a property but you cannot change its location.

COMMIT TO ONE AGENT AND TOUR HOMES TOGETHER

› Let’s talk! There are dozens of off-market and coming soon listings in San Francisco which are not marketed to the public. Properties in San Francisco are not straightforward and value isn’t always obvious. Your agent should always see any property that you may consider purchasing. They should also obtain the seller’s disclosure documents, actually read them, and review them with you as part of your due diligence. Whether you make an offer or not, consider it education.

MAKE THAT OFFER, BABY!

› Buyers today have an opportunity to negotiate price and all sorts of terms. The worst that can happen is that the seller says no. If your offer is not accepted outright, you can try to find middle ground, agree to everything the seller wants, or choose to walk away. In San Francisco, buyers and sellers use a purchase agreement and other standard forms not used outside the city. Working with an experienced agent who knows them inside and out, respects the local customs, and presents a buttoned-up offer on your behalf will give you an advantage.

All images courtesy of SFAR MLS.