SF Home Prices & Interest Rates Are Both Headed Higher

Every buyer who is ready to make a move should see this moment right now for what it is: a golden opportunity.

Median Sales Price of All Attached / Detached residential properties in San Francisco from January 2005 to present, reported monthly. Data is sourced from NorCal MLS Alliance, via InfoSparks, as of September 8, 2022 and is considered reliable but subject to change.

Since at least 2005, the Median Sales Price of homes in San Francisco has increased by an average 14.4 percent in the first half of the year. Not once in the past 18 years have prices decreased during the January-thru-June period. Even immediately following the catastrophic decline of financial markets in late 2007, the Median Sales Price still rose by 4.04 percent.

With few exceptions, January marks a low point for prices which then rise through May or June before moderating and perhaps falling in Q4. In only eight of the last 17 years did the Median Sales Price fall between September and year-end. Whether it happens in 2022 is a total toss-up. If it does, it will all but certainly be a meager single-digit drop. The tradeoff in trying for a screaming deal during the holiday season is a picking from a dismal selection of homes.

Percentage increase from August to September of New Listings of All Attached / Detached residential properties in San Francisco from January 2005 to present, reported monthly. Data is sourced from NorCal MLS Alliance, via InfoSparks, as of September 7, 2022 and is considered reliable but subject to change.

This September is, so far, off to a mediocre start in terms of New Listings. Approximately 80 Single-Family and 140 Condo/TIC/Coop properties have come on the market since the first of the month. At this pace, the month-over-month increase in new listings from August may be around 50 percent — and it will be the smallest number of new listings in at least five years.

If this is a sign of things to come, then inventory in 2023 may be less plentiful than it has been in a while. Sellers are grappling with the fact that market conditions are no longer in their favor, for the first time in nearly a decade. Inventory will tick up when they believe it is a good time to sell, and that pivots — in part — on consumer behavior.

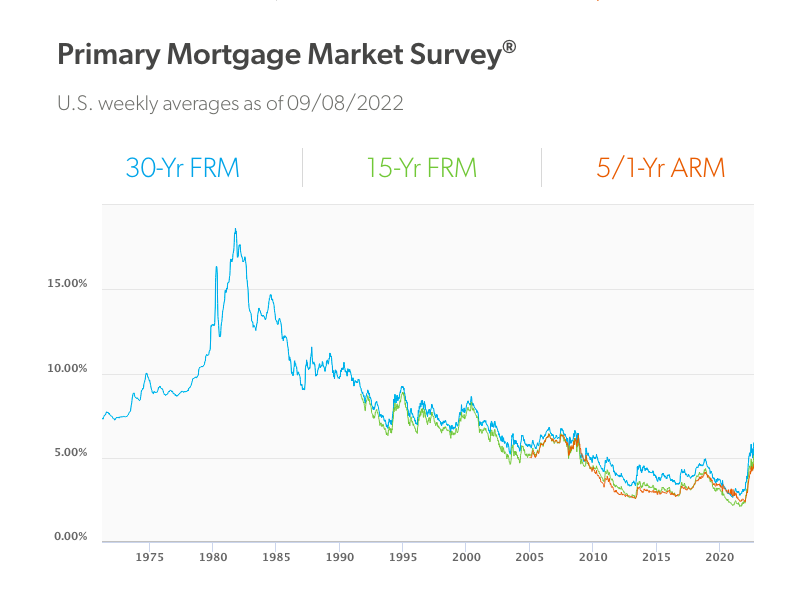

The latest Freddie Mac Primary Mortgage Market Survey shows a doubling of the average 30-Year and 15-Year FRM interest rates since this time last year. That’s a negative shock to borrowers’ purchasing power as well as their enthusiasm to buy. The sub-3 percent rates seen in 2020 and 2021 are the lowest in more than 50 years of record-keeping. As the proverb goes: all good things must come to and end.

Interest rates above 5 percent are in keeping with historical averages up until 2009. Once borrowers wrap their minds around this and accept that all-time low rates aren’t returning anytime soon, expect demand for homes to rebound. That said, there is no reason to believe that rates will not rise toward 7 percent in early 2023 as the Fed continues to address inflation.

TAKEAWAY

Attempting to time to market is often futile. It’s true: peaks and troughs are seen only once they’ve passed. Prices are only part of the equation, too. Home buyers who have been watching for a bottom since the pandemic hit will now have a significantly higher monthly payment due to interest rates despite any price adjustment. Not to mention the rents they may have been giving their landlord all the while. From this point forward, buyers may well look back and kick themselves for not taking the plunge earlier.

San Francisco’s real estate market is a resilient one. Relative to other areas, it is late to respond to economic downturns, impacted less, and quicker to recover. Without doubt, it has cooled over the past six months. And it’s only a matter of time until the fundamentals that make it so voracious in boom periods — the city’s attraction of business and talent, high wages, and an overwhelming shortage of housing, just to name a few — will again make homebuying here a highly competitive endeavor.

Buyers who are ready to meet the opportunity that exists today need to do a few things:

1. Consult with a local lender and obtain mortgage pre-approval. This is essential before making an offer, and can take anywhere from a few days to a week or more. Consider speaking with more than one lender and making them compete for your business. Having your loan file already reviewed by the underwriter will allow you to make a stronger offer. If you plan to stay put in your new home for only a few years, choosing an adjustable-rate product will lower your interest payment. Contact us and we can point you in the right direction.

2. Familiarize yourself with the inventory of homes for sale AND recently sold homes. Homes today are more likely to sell at or near the asking price, but this is by no means a rule. Egregious underpricing is still a common strategy used by sellers and their agents to attract interest (and multiple offers). Be willing to compromise on your wants — if you wait to find the perfect home, you’ll be waiting forever. You can upgrade and personalize a property but you cannot change its location.

3. Commit to one agent and physically tour homes together. Let’s talk! There are dozens of off-market and coming soon listings in San Francisco which are not marketed to the public. Properties in San Francisco are not straightforward and value isn’t always obvious. Your agent should always see any property that you may consider purchasing. They should also obtain the seller’s disclosure documents, actually read them, and review them with you as part of your due diligence. Whether you make an offer or not, consider it education.

4. Make that offer, baby! Buyers have uncommon leverage right now to negotiate price and all sorts of terms. The worst that can happen is that the seller says no. If your offer is not accepted outright, you can try to find middle ground, agree to everything the seller wants, or choose to walk away. In San Francisco, buyers and sellers use a purchase agreement and other standard forms not used outside the city. Working with an experienced agent who knows them inside and out, respects the local customs, and presents a buttoned-up offer on your behalf will give you an advantage.

You can always live chat with us to get real-time data and a qualitative take on the market. We’re actively identifying unique opportunities and making deals happen. We know what’s good!

Subscribe to broker insights, top headlines, off-market listings, and new development launches delivered monthly to your inbox.

SF House & Condo/TIC/Coop Market Metrics, April 2024

The following is adapted from the April 2024 Monthly Indicators report published by the San Francisco Association of REALTORS®. Elevated mortgage interest rates and rising...

SF Askhole Of The Month, April 2024

If the head-turning world of San Francisco real estate has any constant no matter the times, it's OUTRAGEOUS overbids. Indeed, local agents have a unique and longstanding...

2177 Third Is 80% Sold, New Home Prices Reduced

When it comes to modern condominium developments in the Dogpatch neighborhood, 2177 Third is the standout. Premium is the standard here, from resident concierge and valet...

What $1 Million Buys In SF’s North Panhandle

As the Median Sales Price in San Francisco continues to rise — up ±18% from the start of the year — homes priced to sell under $1 million are increasingly hard to find. In...

Inside The $13 Million Penthouse At 181 Fremont

Word on the street is that San Francisco's condo market is on the mend. According to data reported to the San Francisco Association of REALTORS®, last month's Median Sales...

Home On Alamo Square’s “Seattle Block” Prepares For Sale

The world-famous painted ladies of Postcard Row draw millions of visitors to Alamo Square each year, but the historic district has no shortage of eyepopping real estate all...

SF House & Condo/TIC/Coop Market Metrics, March 2024

The following is adapted from the March 2024 Monthly Indicators report published by the San Francisco Association of REALTORS®. Across the country, existing-home sales...

VIP Homes For Sale: Janis Joplin, Haig Patigian, Ken Fulk

It's a line as true today as it was when Paul Kantner said it over a half-century ago: San Francisco is 49 square miles surrounded by reality. Indeed, it's an undeniably...